Expertise Amplification: Perfecting B2B Content for Prospects Who Out-Expert You

tldr

In B2B marketing, when prospects know more than you, the Expertise Amplification Method (EAM) helps create content that resonates without needing to out-expert the experts. The basic flow is to identify a topic, survey pros, craft great content, use it as a lead magnet to get emails and then rinse and repeat. Now, who’s up for a quick survey?If you’re in the world of B2B marketing, getting attention is all about expertise.

To educate (and, of course, to get someone’s attention to sell), you need to prove that you know what you’re talking about. Selling HVACs? You better prove you’re all about the refrigeration cycle and that you eat, breath and sweat compressors, condensers, expansion valves, and evaporators.

But typically, when you’re selling B2B, educating is very, very hard. Because your prospect is going to most likely know more about the field than you ever will . And you can’t educate when you’re supposed to be the student, right?

This tension is the #1 killer of good thought leadership. You can’t lead if you’re trailing when it comes to expertise.

There’s one very popular way that many B2B marketers try to fight this.

Fighting The Niche Fight

The typical way marketers deal with this is going deep - build out a true niche in the field. This isn’t wrong, it’s just limited.

The approach works as follows.

Sure, the prospect may know more about cloud security than you do in general…but they are never going to understand how how Quantum Nebulous Encryption (QNE) harnesses stochastic resonance of quark-level cryptographic oscillations to obfuscate payload meta-structure by harnessing better Synaptic Cloud Shield Protocols better than you.

What Dalle thinks QNE's brochure looks like

(For the record, I have never had more fun writing a paragraph than the tech I just invented above. And yes, I’m going to trademark Synaptic Cloud Shield Protocols.)

But when you go really, really deep, you sometimes lose broader appeal. How many people wanna read research about that? What’s the search volume? Are you going to get invited to panels to talk about that? Probably not.

There’s (obviously) another way to go expert without going deeper than the Marinara Trench.

I dub it (drumroll…)

The Expertise Amplification Method

(or the EAM, cause cool methods have names and acronyms)

The EAM (or, for a more basic title - b2b content feedback loop ) turns your audience into the heart and soul of your educational content.

It actually relies on your audience knowing more than you. Once you recognize that fact, you do everything you can to extract the expertise, distill it, repackage it, and then flip it right back at them.

Here’s the stages:

- Identify a broadly appealing category with some degree of connection to your product.

- Survey a cohort of at least 20 professionals in your space

- Create content based on the insights you pick up with a lead magnet of some sort

- Survey the responders with other questions

- Rinse and repeat

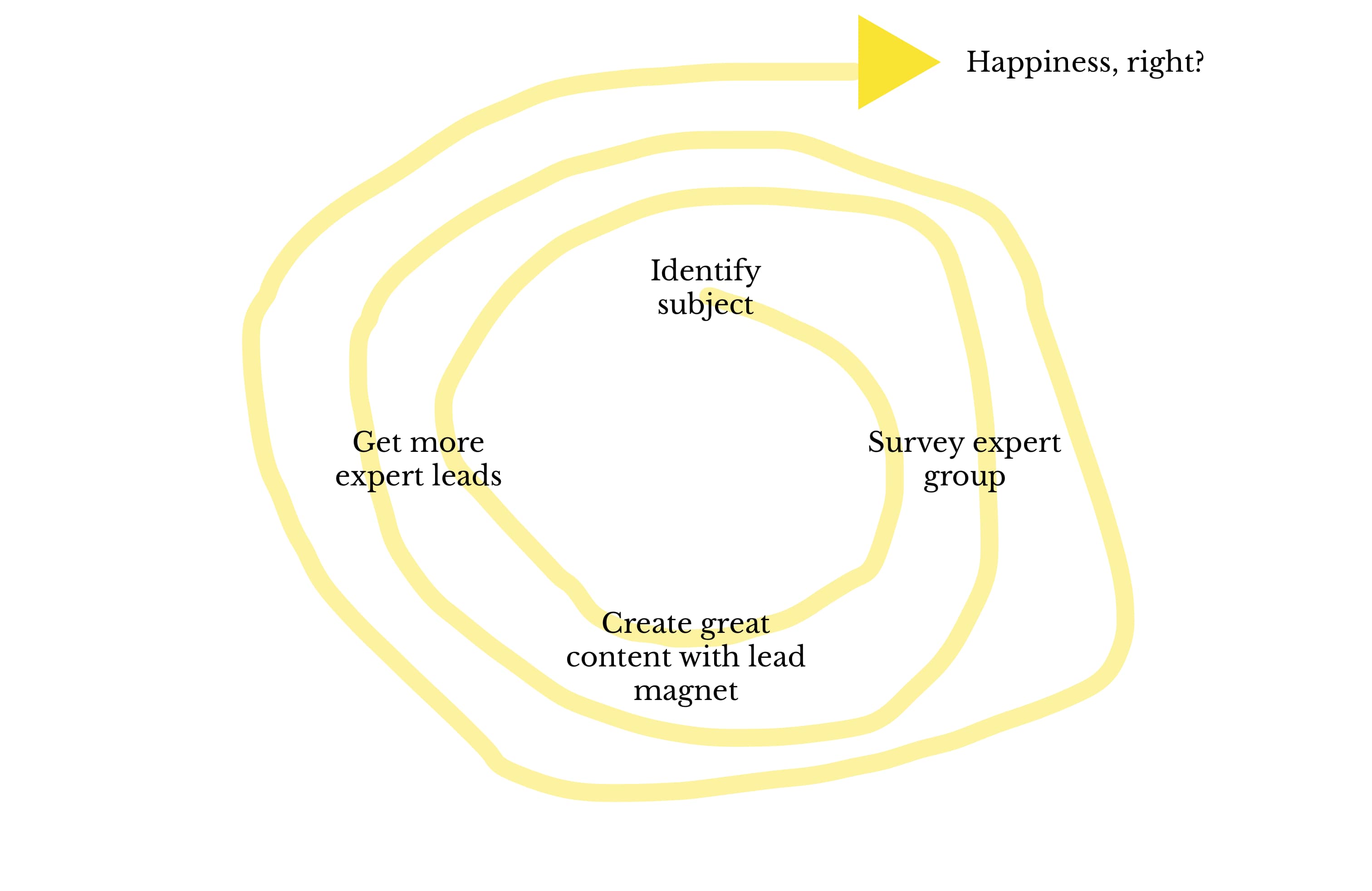

Feels more official with a diagram

Here’s an example of what the output looks like in practice.

Let’s deconstruct the phases.

The Stages of E.A.M

Identify Subject

This is the hardest part. When you’re gathering data for a meaty piece of content, you’re sidestepping the need for your own revolutionary insight. Instead, you find the experts and ask them (typically) multiple choice question to unearth a descriptive perspective on their industry and what they are facing.

Got your back with soem samples. Your questions should focus on industry shifts, competitive dynamics, and your prospects' top concerns, along the lines of:

- How has digitization impacted [industry]?

- Which of the Big Tech Competitor’s has been increasing its market share?

- How has [major tech trend like AI] impacted your internal [relevant KPIs]?

- What are you most worried about?

- How has [large market event] impacted you? Or your customers?

- Which of the [common tech tools] are you currently using? Which are you planning on using?

And so on. When possible, follow one of them with a qualitative open text question. Another idea that’s worked for me is to end the multiple choice questions with an open-text “Other”. The result is BYOI (Bring Your Own Insight)

Survey Expert Group

Congrats, you’re the proud owner of a survey. Which is worthless without…respondents.

Send the survey out to at least twenty outstanding professionals.

Yea, that sounds sounds crazy small.

But it's not! . I promise. Take a look at most McKinsey or Gartner studies. As long as the people they survey are qualified, they don’t need that many respondents to show industry trends. People pay attention to one smart person; of course they’d listen to twenty.

One caveat though - the smaller the audience, the more you need to prove that they are super-relevant. For example, take a look at the logos and try to quantify the respondents' qualifications with something like:

30 respondents from companies that collectively represent over $50 billion in revenue

This gets easier the more you run these (you’ll see why soon) but the first time, you might need to pull out all stops to get the answers.

Typical easy sources to get that jump-started is:

- Getting your CEO to reach out to industry players

- Cold outreach to LinkedIn professionals

- Reaching out to (very) warm prospects or customers

- Walking up to people at industry events

- Making up answers (joking, please don’t do this)

When it comes to tooling, the survey tool doesn’t really matter so much. I’ve used Typeform in the past but Google Forms should work too.

Whatever you use, try to use the same tool for each survey. This is especially true if you end up creating longitudinal pulse surveys were you track changing opinions or trends.

Create Great Content

Congratulations, you now have industry insights.

Now you’re on a normal content track.

Take the responses and hammer them into insights. Analyze the results, reach out to some respondents with followup questions based on the data, and hone it. Then add your own insights, ideally somewhat related to the answers you got. Voila, you have a piece that’s worth its weight in leads.

Distribution for this piece is relatively simple but pay special attention to trade publications; that’s where you will really get your loop paying off (one example of that is here).

The qualified people you are trying to get in front of are looking for deep industry insights. Those aren’t typically in Axios or the New York Times. They’re in the same watering hole where their fellow experts congrats.

Either way, in order to unlock the EAM loop, you need to get new leads. You probably also need the leads to, I dunno, keep your job.

So the trick to this is all is that on top of whatever insights or content you publish, you need a lead magnet. For me, that can be:

- Letting people download an expanded version of the report

- Letting people download the charts or even the raw (anonymized data)

- Offering access to a webinar about the report

- An executive summary of the report.

Just to step outside of my cold, lead-in self…this isn’t just about leads and marketing. This process genuinely generates interesting results that can move an industry forward. Many of our sales decks start with insights we gather from these surveys. I really do believe that this is an unlock for very useful, expert-inputted content that drives value to both your business and your readers.

Either way, you’ll need those lead-generated emails for…

Survey Again

This is the magic of the feedback loop.

If your research was interesting and your distribution was solid, you’re going to get some downloads from the same type of person that likely answered that first post. And that’s where the amplification loop comes in.

Wait a few weeks or months.

Then start the same cycle, coming up with either another set of questions or, if the industry changed from something dramatic (ie, COVID), ask them the same questions and show how things have changed. You may sometimes need to juice the audience a little but more - don’t be scared to raffle off one $50 Amazon gift card as a thank you. But this time, you also send the survey out to the new people who downloaded the report. Just like that, you’ve gone from 20 respondents to 30. And then, over time, you start expanding from one buyer persona or company to another. More expertise, more content and more of it expert-generated.

This isn’t just a loop; it’s an upwards spiral, elevating your content and building your audience with every turn.

The best part? It's built on a foundation of respect for your audience's expertise. It also builds an audience that you can tap for quick surveys when you really need an answer urgently for something that a reporter asks for.

It works for me. That’s all I can say.

Postscript: Invest Or Don’t Do It

The difference between good content and outstanding content is the difference between a massive waste of time and a dominant market position. If you can’t come up with great questions and get that 20+ answers, or you can’t turn it into a decent report, you’ll save a lot of time and grief by just choosing another channel.

But if you have the questions, have the curiosity, have the drive to get those initial respondents and are looking to be an industry educator….go forth. This works. I promise.

And, if you don’t mind, would you answer a few questions for me 😉